Texas hail damage insurance claims alone account for more than 20% of the national total on hail damage insurance claims. With Texas topping the list for total number of hail events nationwide, chances are you may have to file a hail damage claim in your life. Hail causes all sorts of damage to homes and property but it can be especially brutal to your roof. If your hail damage claim has been denied or you have been offered a fraction of what you deserve, you need an experienced attorney to pursue the damages you are entitled to.

Why You Need an Independent Inspection

- Hail damage can have lasting damaging effects. The extent of your hail damage may not always be immediately noticeable, especially to the untrained eye. Rust, rot, and roof leaks can form over time if the hail damage is left unrepaired.

- Insurance companies make their money by not paying out claims. They will do their best to deny your claim for any number of reasons. The common reaction following a damaging event is to contact the insurance company; they will then send someone to survey the damage. This is strongly discouraged. Inspectors sent by the insurance company have been directed to find the least-expensive solution to minimize the claim amount.

- You need your own value assessment. Our office can, at no charge, place you in contact with an independent inspector so that you may go in to your claim armed with more information. It is important to have an insurance expert on your side when filing a claim for hail damage – someone trained to look for and spot hail damage – if you want to increase the chances of your damage being covered.

Why Hail Damage Insurance Claims Are Denied

Claims are wrongfully denied all too often. Most of the time insurance carriers deny claims by taking the position that there is no actual damage, or that the damage caused was insignificant, keeping it below the deductible. They will label your claim as having “no structural damage” or claim the damage was “cosmetic only”. An insurance attorney will stop them from treating your claim with such disregard, and work to get the compensation you are fairly entitled to.

Even when insurance companies do pay out they will try to cut corners wherever possible to limit their expense. One of the common practices insurance companies use in hail damage claims is to replace individual roof shingles, rather than replacing the entire roof. Companies do this to keep claims under the deductible amount even when the policy states the entire roof should have been replaced!

Hail Damage Leads to More Expense

The repeated, rapid assault of hailstones weakens the objects they impact. This often-hidden damage weakens your structural integrity, reducing the life of your home and other property.

Repeated hail strikes cause long-term damage to:

- Asphalt, by chipping the protective layer

- Roofs, by weakening roof support and integrity

- Metal, causing microscopic cracks leading to premature corrosion.

- Other property subject to repeated, hard impacts

Hail has a dramatic effect on the lifespan of a roof. When you sell your property any existing hail damage will be identified by the inspector who will then notify any potential buyers.

Hail Claim Testimonial

The Insurance Company Will Pay for Only a Partial Fix. What Can I Do?

If your insurance company is trying to save money by fixing only part of the overall damage and you disagree, you do have options. A request for full compensation may be made to the insurance company but it is required to be submitted in writing. Insurers are notoriously stubborn; it is extremely difficult to get them to change their position once they have taken one. Your attorney will work to diligently to get them to do just that.

Independent experts, roofers, or contractors can help sway the decision in your favor. Most often property owners have to hire an attorney to get results. An insurance attorney will review the claim, adjuster recommendations, and any other information to pursue a breach of contract claim or a bad faith claim against the insurance carrier.

My Carrier says I only have cosmetic damage?

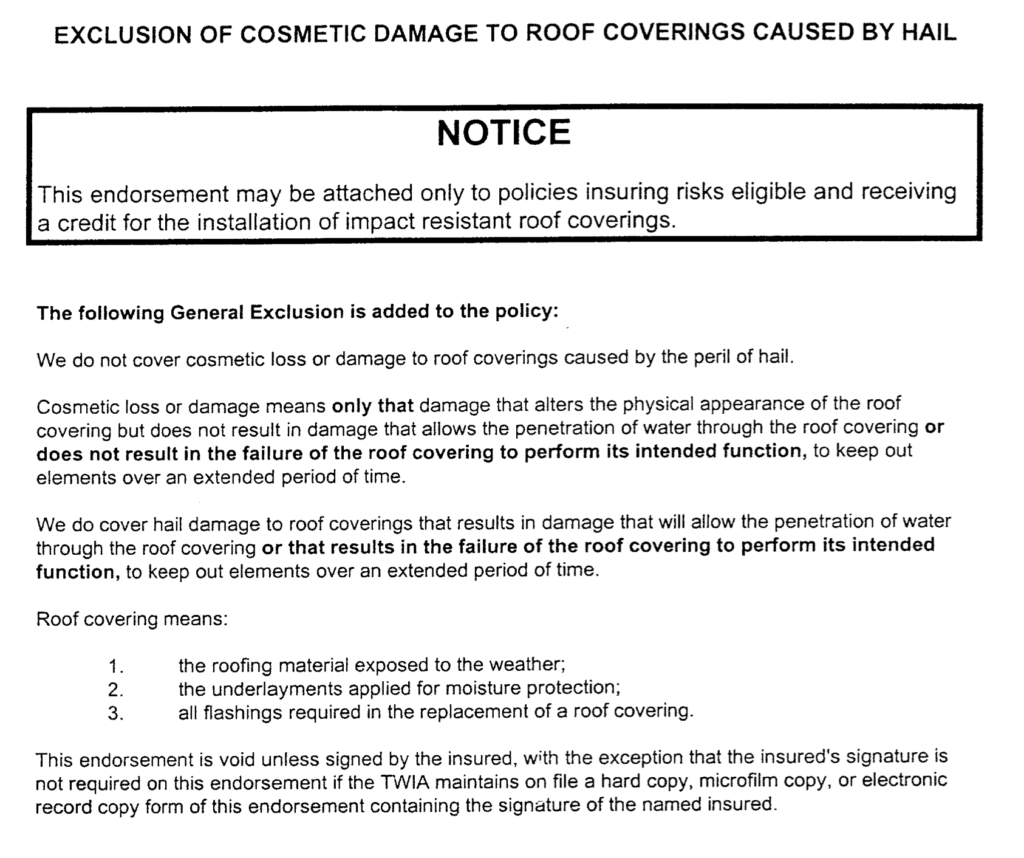

In hail prone areas, insurance carriers have started offering cosmetic damage endorsement waiver. These are often called “Exclusion of Cosmetic Damage to Roof Covering” Endorsements. They read similar to this:

We do not cover cosmetics loss or dam,age to roof covering caused by the peril of hail. … Cosmetic loss or damage means only that damage that alter the physical appearance of the roo covering, but does not result in the damage that allows the penetration of water through the roof covering …

If you have this issue, please email our office, we can help. The issue is the the outer lawyer of a roof covering is designed to protect the waterproof material from the elements. Once the outer lawyer is degraded, you have damage to the shingle or the roof and the claim should be covered. We address this in more detail in this video:

If you have this issue, please email our office, we can help. The issue is the the outer lawyer of a roof covering is designed to protect the waterproof material from the elements. Once the outer lawyer is degraded, you have damage to the shingle or the roof and the claim should be covered. We address this in more detail in this video:

Hail Damages Just About Everything

Hail stones will damage just about everything in their path. Hard, frozen water falling from the sky can be very powerful. Despite this obvious fact, insurance companies tend to quickly (and quite wrongly) dismiss the majority of hail impacts as ‘merely cosmetic’.

We have discovered previously overlooked structural damage on many properties for our clients, including damage to:

- Bricks

- Fences

- Siding

- Garage Doors

- Air Conditioners

- Window and Screens

- Pool Decks

If your property has suffered hail damage and your insurance company is trying to deny or underpay your claim, you need to act fast and hire an experienced Houston property damage attorney. Contact the Fitts Law Firm today for a free, confidential review of your damages, policy, and claim. We will explain the options available to you and tell you how we can proceed with your case.