The first recorded EF-3 tornado in Texas in January touched down in East Houston delivering catastrophic damage to many homes and businesses in the cities of Deer Park and Pasadena, Texas. Many residents are trying to determine what to do next after the January 24, 2023 storm. The public outpouring of support has been amazing, but how do you deal with your insurance company? Our experienced insurance claim lawyers, provide information for Deer Park and Pasadena residents below.

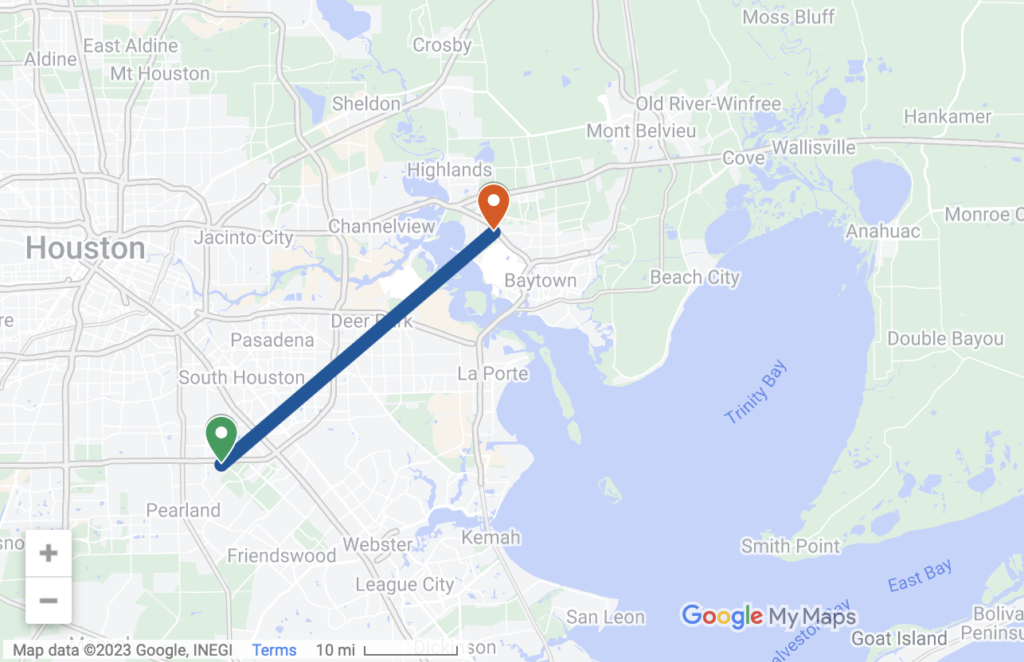

January 24, 2023 Tornado Path in Deer Park and Pasadena

January 24, 2023 Tornado Path in Deer Park and PasadenaTips for Reporting your January 24, 2023 Tornado Damage

Assuming you have timely reported your damage, make sure your insurance company timely inspects your damage. They will try to put you off, but they have an obligation to reasonably inspect your damage so you can start to get back to normal. Remember that the adjusters work for the insurance company and they are collecting evidence relating to the extent and the cause of your damage. This information will be used and reported back to the home office of the insurance company to decide what they owe you for your damage.

Since they work for the insurance company and they are often overworked, they frequently overlook damages that are not completely obvious. A Policyholder can help an adjuster by being organized, tracking activities and costs of the cleanup and recovery, providing any information to the adjuster, keeping notes of all meetings and correspondence with the adjusters, and carefully detailing the losses and expenses incurred.

What should I ask my Insurance Adjuster?

Is is smart and fair the ask the following questions of your insurance company and their adjuster. You signed a contract and so did they. Now they need to provide the benefits they promised.

- Can I get a partial payment ASAP to start my repairs and cleanup?

- How much am I entitled to under the policy for my damages?

- How long will is take for the insurance company to issue a payment?

- What can I do to speed up the process of receiving the money I am owed?

- When is the next time should I hear from you of the insurance company?

How to talk to the Insurance Company

- Be Honest – They might try to deny your claim if they think you are not being truthful. Submit valid, real invoices. Do not make up invoices that do not exist. You are not required to have invoices of items that were purchased before the storm. You will just need to present something reasonable that will represent the value of the item you seek to replace.

- Do not accept responsibility – The truth is that the January 24, 2023 tornado damaged your property. Remember that. If you imply that you have some responsibility for why your property was damaged, they might try to use it against you.

- Avoid a Recorded Statement – Some polices require a statement under oath. Although permitted by some policies, insurance companies do not always ask for these. When they do, they might think there a possibility of fowl play. If you do give a recorded statement, make sure you do not contradict yourself or blame yourself for the damage. Always request a copy of the transcript so you can correct any inaccuracies in the transcription.

When to seek an attorney for a tornado claim

Try to go through the claims process. Sometimes the process gets off to a rocky start, but eventually work out. If you think the adjuster is giving you the run around, you need to seek advice of legal counsel.

Improper inspections, slow payments and inadequate assessments or payments of insurance claims are violations under Texas law. The Fitts Law firm has helped thousands of business and homeowners get maximum value for their insurance claims after the insurance company improperly delayed or denied the claim.

How much does it cost to hire an attorney for January 24, 2023 Tornado damage?

We have been helping policyholders for years and we understand how emotionally and financially challenging a tornado loss can be. That is why we do not charge a legal fee until we are successful with your claim. Also, we will hire damage experts to assess your damage and testify in court, should the case go to trial. Once you hire a law firm, you can focus on putting your life back together and we will put pressure on the insurance company to resolve your claim for maximum value. Also, if you hire a lawyer you can recover your attorney fees from the insurance company as well.

Tornado Claim Testimonials

If you have tornado damage, but the insurance company is ignoring you, contact the insurance experts at the Fitts Law Firm today for your free consultation. Professional and experienced legal assistance with your insurance claim is only a click away.